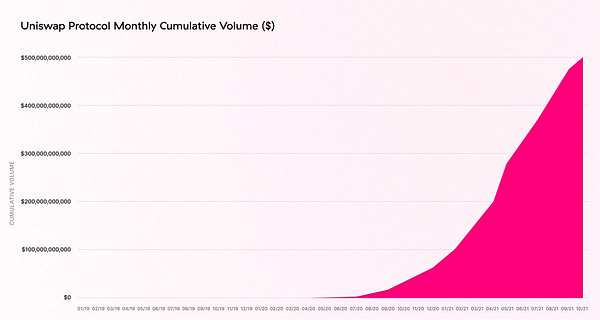

Yep, that is $500 000 000 000 in total traded volume 🥳, see you soon at the 1 trillion

Governance

Snapshot consensus check to move DEF’s funds into a custodial wallet from the multisig has been defeated with a 2.72mil UNI (99.92%) voted against the move

Snapshot consensus check to add 0.01% fee option to the liquidity pools, has finished with 16.36mil UNI (100%) voting in favour of adding a 1bps fee tier with 1 tick spacing

Proposal discussion around investing $1-5mil worth of UNI into BED index by the bankless community, to diversify the treasury?

Updates

We continue to see interest and venturing into DeFi by the traditional financials, this time by a Valour Inc., a Switzerland-based issuer of digital asset-based exchange-traded products (ETPs) through a release of first ever UNI ETP giving the institutional investors direct exposure to the UNI

Zapper have added support for actively managed Uniswap v3 LPs through visor.finance protocol

simplify.finance have release closed beta v1 that supports Uniswap and should make process of tracking and managing your DeFi positions more simple, welcome to the analytics crew. Just on I side note, there now a family of awesome analytical projects build on top of uniswap, those that I know of are revert.finance and croco.finance

revert.finance have also published a super cool 🎉 list of all the active incentives programs running on top of v3, definitely check it out

I’ve also started curating Uniswap twitter list for projects and people involved in the ecosystem and awesome-uniswap one on github, so please feel free to make a PR or DM me for any suggestions, thank you!

Grantees

DEF have published their expenditure update #2 notifying of future multisig withdrawal of 500,000 USDC

Events

UNICODE is now live, tune in to see what hackers are buidling, workshops, product presentations and LoFi sounds, finale and winners announcements will be held on 10 of November

Checkout “The Price is Right” talk about Uniswap oracles by @NoahZinsmeister from the UNICODE kick-off event

Edition #5 Project

Consider supporting rekt.news, I’ve been using their feed to track Uniswap related news for curating this newsletter, and there is much more interesting reading stuff to be discovered there. Don’t get rekt

Thank you for reading!

Please, feel free to follow us on twitter, give feedback or share resources for the upcoming letters

Much love @wijuwiju